The “One Big Beautiful Bill” Just Passed the House. Here’s What It Means for You.

In a razor-thin 215–214 vote, the House of Representatives passed President Donald Trump’s sweeping tax and spending package, officially titled the “One Big Beautiful Bill Act.” This 1,100-page legislation promises historic tax cuts, major shifts in healthcare policy, and significant changes to energy incentives. But beneath the headlines, it’s a bill that sharply divides the country—by income, geography, and political ideology.

What’s in the Bill?

The One Big Beautiful Bill Act is a massive, 1,100-page proposal that reshapes U.S. tax and spending policy for years to come. If signed into law, it would:

- Permanently extend the 2017 Trump tax cuts, which lowered income tax rates across all brackets, with the biggest benefits flowing to high earners and corporations.

- Eliminate federal taxes on tips and overtime pay, a populist move aimed at service and gig economy workers.

- Increase the Child Tax Credit to $2,500 through 2028 (up from $2,000), though without making it fully refundable—limiting its impact for the lowest-income families.

But there’s a lot more.

The bill slashes over $1 trillion from safety net programs over ten years:

- Medicaid would see steep funding reductions, alongside the introduction of stricter work requirements—a change expected to disqualify millions from coverage.

- SNAP (food stamps) eligibility would be narrowed, with similar work and reporting mandates.

- It also rolls back green energy incentives, cutting tax credits for solar, wind, and EVs that were expanded under the Inflation Reduction Act.

At the same time, it increases spending on border security and defense, including new funding for southern border infrastructure, DHS hiring, and Pentagon modernization.

“The current Republican tax bill could cut $500 billion from Medicare between 2027 and 2034. This bill just gets more and more cruel.”

— MarketWatch, citing budget impact under statutory PAYGO rules

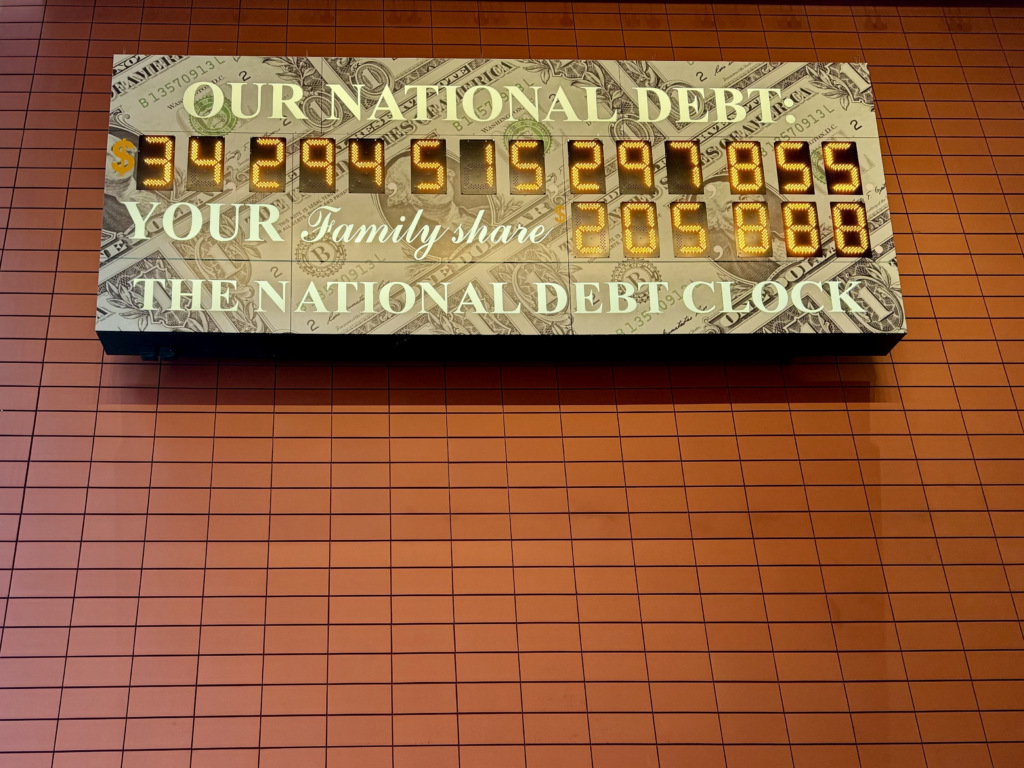

Economically, the price tag is staggering. The Congressional Budget Office projects that the bill would increase the federal deficit by $2.4 to $3.8 trillion over the next decade, depending on final scoring and interest rate effects.

That projected deficit led Moody’s to downgrade the U.S. credit rating, citing “unsustainable long-term fiscal trends.”

In short, the bill mixes short-term tax relief with long-term structural changes—many of which carry deep consequences for healthcare, social programs, and the federal balance sheet. Whether that tradeoff is worth it depends entirely on where you stand.

What Everyone Agrees On

Amid the bitter fights, a few provisions managed to draw real bipartisan support.

One major point of agreement is the State and Local Tax (SALT) deduction cap. The bill raises the cap to $40,000 for households earning under $500,000, a sharp increase from the current $10,000 limit set in 2017.

That change delivers real relief for middle-class families in high-tax states like New York, New Jersey, and California—many of whom have been paying more federal tax since the cap was imposed.

Moderates from both parties pushed hard for this fix. Without it, the bill likely wouldn’t have passed the House.

Another shared win: small business tax relief. The bill makes the Section 199A deduction permanent and bumps it from 20% to 23%, helping pass-through businesses—LLCs, sole proprietors, and freelancers—keep more of their income.

It’s a modest change with meaningful impact, especially for local businesses still recovering from COVID-era losses.

These points of agreement don’t erase the controversy, but they do show that dealmaking isn’t entirely dead on Capitol Hill.

Democratic Concerns: Healthcare and Equity

Democrats have been blunt: they believe this bill rewards the wealthy while punishing vulnerable communities.

One of their biggest concerns is Medicaid. The bill imposes tougher work requirements that the Congressional Budget Office says could cause 8.6 million people to lose coverage. That includes low-income adults, many of whom already work unstable or part-time jobs.

The SNAP program, which provides food assistance to low-income families, is also on the chopping block. Up to 11 million recipients could be affected by new eligibility rules and documentation requirements.

Then there’s the climate piece. The bill accelerates the phase-out of clean energy tax credits, including those for solar panels, electric vehicles, and wind energy projects. Democrats argue this move will stall climate progress just as momentum was building under the Inflation Reduction Act.

They see the bill as a rollback of safety nets and a reversal of gains on environmental and economic equity.

Republican Divisions: Fiscal Responsibility vs. Party Loyalty

Even among Republicans, the bill isn’t universally loved. Some see it as politically convenient—others see it as financially reckless.

Senators Ron Johnson and Rand Paul have been especially vocal. They say the bill’s projected $3.8 trillion price tag makes it a “Disney World trip America can’t afford,” and warn it undermines decades of GOP messaging on debt and deficits.

There’s also backlash over the SALT cap increase. While it’s a win for swing-district lawmakers, many hardline conservatives argue it’s a giveaway to wealthy homeowners in blue states.

The result is an awkward split: a bill that champions Republican tax priorities but also challenges the party’s traditional stance on fiscal restraint.

What That Means for You

This bill isn’t just about D.C. politics. It’s about your wallet, your healthcare, and your neighborhood. Here’s who stands to benefit—and who’s left carrying the weight.

Winners

Middle-Class Families in High-Tax States

If you live in a place like New York, California, or New Jersey and make under $500,000, you’ll likely feel a boost. The bill raises the SALT deduction cap to $40,000, letting you deduct more of your state and local taxes. That’s money back in your pocket—especially if you own a home or pay high property taxes.

Small Business Owners

From barbershops to freelance designers, small business owners get a rare win here. The bill bumps the Section 199A deduction up to 23% and locks it in permanently. That means lower tax bills for millions of pass-through businesses, giving Main Street a little breathing room after years of inflation and pandemic recovery.

Losers

Low-Income Individuals

This is where things get more painful. New work requirements for Medicaid and SNAP could push millions off the programs entirely. If you’re juggling part-time jobs, caring for family, or in a rural area with fewer opportunities, you might suddenly lose access to healthcare and food assistance—even if you technically qualify.

Clean Energy Workers and Consumers

The bill also guts many of the green energy tax credits that had fueled solar panel installations, EV purchases, and clean energy jobs. For workers in growing renewable sectors, it’s a blow to job growth. And for consumers, those cost-saving incentives? Gone.

The shift may slow America’s climate progress and send clean energy investment overseas, according to analysts.

What’s Next?

The bill now moves to the Senate, where it faces an uncertain future. With only a slim Republican majority, any dissent within the party could derail the legislation. Senate Majority Leader John Thune has indicated that substantial changes may be necessary to address fiscal concerns and secure passage.

The goal is to finalize the bill by July 4, ahead of a looming debt ceiling deadline in August. As the debate continues, the nation watches closely, aware that the outcomes will have lasting effects on the economy, healthcare, and the environment.